ICOs Can't Cash Out To Fiat

- Yanna L

- Hong Kong

- 11 September 2018

Looking at the recent ETH price drop is depressing. From the looks of it ETH is plummeting because ICOs are cashing out in fear of a further price drop.

But what most of us miss out in the picture is that even if they sold their ETHs, those money has to stay inside the crypto-ecosystem. The money is trapped.

They could either sell it for Bitcoin or Tether. But if they sell it for a huge sum of USD, and are hoping to take that to a bank to cash out in fiat, then I am afraid that simply won’t work.

You Can’t Find A Bank That Would Let You Cash Out

In our previous queries to multiple banks, simply no banks would deal with you for the fear of money laundering fines. If you cash out in the United States, then you would have serious difficulty in explaining why you didn’t register your ICO as securities or other regulated financial products beforehand.

The Only Jurisdiction That Gives No Legal Hurdles to ICOs – Belarus

Currently, there’s only one place that legally allows for ICOs. That place is Belarus. But even so, as of today, their banks refused to deal with cryptocurrency clients.

That’s why their only local exchange called Exrate.by couldn’t launch as planned.

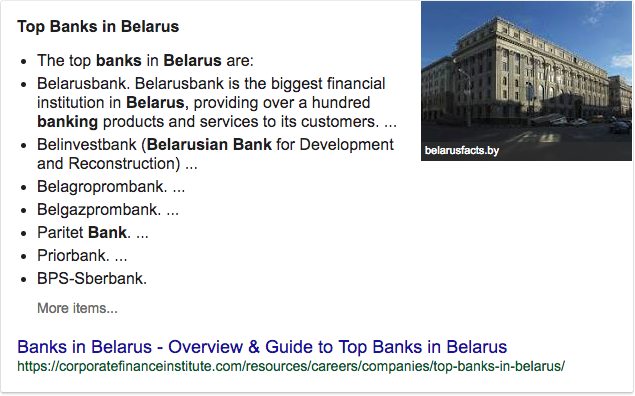

Even if you found some ways to cash out for the Belarusian Rubles with the locals through LocalBitcoins, and then deposit those Belarusian Rubles in an established bank shown below, you would still have problems.

–

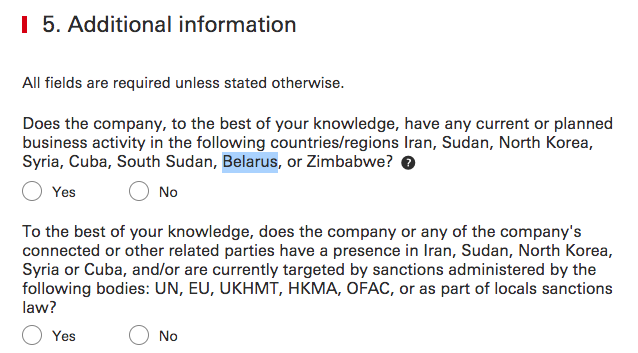

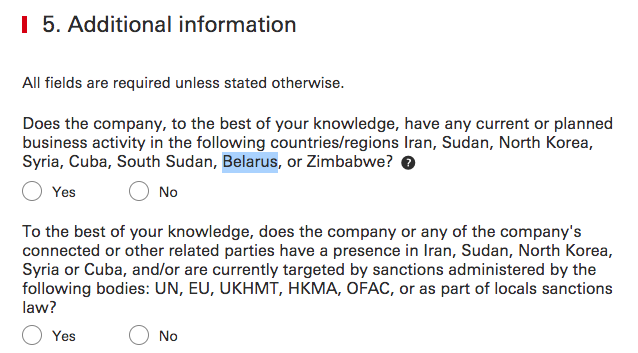

All the banks in developed parts of the world have signed anti-money laundering treaties, and when they onboard you as a client, they have boxes to tick. One of them, they ask if you have a previous course of dealings with any Belarusian institutes. And if you do, your application will get rejected.

–

So even if you were able to cash out for Belarusian Rubles in Belarus, you can’t send that money anywhere abroad.

The Take-Away: I Think All The Money Are Really Still Inside The Ecosystem

If this understanding is accurate, then the price up or down of the ETH is really only a false alarm. Because the ICO money hasn’t actually left. They are somehow still trapped in the ecosystem. And when the time is ripe, I suspect that this sum of money will buy in again.

I could be wrong. But this is the only sensible interpretation I can come up with, from my years of experience working in the financial industry.

(These are just my views. This article doesn’t represent the views of the website hosts.)

by Yanaa L, Hong Kong

11 September 2018

Follow Us!

For all the latest insights!

Follow Us!

For all the insights you want.

Stay up to the date with the latest developments in the cryptocurrency space. We write about what we concern. We aren’t sponsored by anyone. Follow us on Twitter!

ICOs Can't Cash Out To Fiat

- Yanna L

- Hong Kong

- 11 September 2018

Looking at the recent ETH price drop is depressing. From the looks of it ETH is plummeting because ICOs are cashing out in fear of a further price drop.

But what most of us miss out in the picture is that even if they sold their ETHs, those money has to stay inside the crypto-ecosystem. The money is trapped.

They could either sell it for Bitcoin or Tether. But if they sell it for a huge sum of USD, and are hoping to take that to a bank to cash out in fiat, then I am afraid that simply won’t work.

You Can’t Find A Bank That Would Let You Cash Out

In our previous queries to multiple banks, simply no banks would deal with you for the fear of money laundering fines. If you cash out in the United States, then you would have serious difficulty in explaining why you didn’t register your ICO as securities or other regulated financial products beforehand.

The Only Jurisdiction That Gives No Legal Hurdles to ICOs – Belarus

Currently, there’s only one place that legally allows for ICOs. That place is Belarus. But even so, as of today, their banks refused to deal with cryptocurrency clients.

That’s why their only local exchange called Exrate.by couldn’t launch as planned.

Even if you found some ways to cash out for the Belarusian Rubles with the locals through LocalBitcoins, and then deposit those Belarusian Rubles in an established bank shown below, you would still have problems.

–

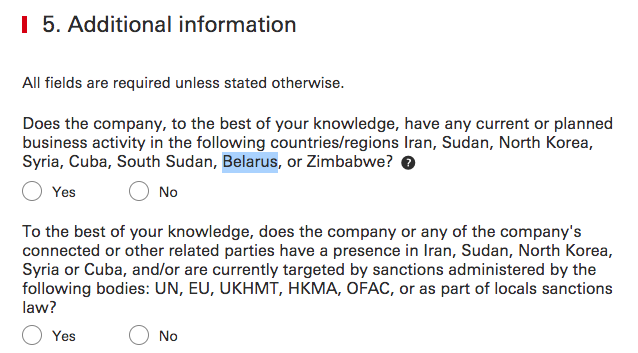

All the banks in developed parts of the world have signed anti-money laundering treaties, and when they onboard you as a client, they have boxes to tick. One of them, they ask if you have a previous course of dealings with any Belarusian institutes. And if you do, your application will get rejected.

–

So even if you were able to cash out for Belarusian Rubles in Belarus, you can’t send that money anywhere abroad.

The Take-Away: I Think All The Money Are Really Still Inside The Ecosystem

If this understanding is accurate, then the price up or down of the ETH is really only a false alarm. Because the ICO money hasn’t actually left. They are somehow still trapped in the ecosystem. And when the time is ripe, I suspect that this sum of money will buy in again.

I could be wrong. But this is the only sensible interpretation I can come up with, from my years of experience working in the financial industry.

(These are just my views. This article doesn’t represent the views of the website hosts.)

by Yanna L, Hong Kong

11 September 2018

ICOs Can't Cash Out To Fiat

- Yanna L

- Hong Kong

- 11 September 2018

Looking at the recent ETH price drop is depressing. From the looks of it ETH is plummeting because ICOs are cashing out in fear of a further price drop.

But what most of us miss out in the picture is that even if they sold their ETHs, those money has to stay inside the crypto-ecosystem. The money is trapped.

They could either sell it for Bitcoin or Tether. But if they sell it for a huge sum of USD, and are hoping to take that to a bank to cash out in fiat, then I am afraid that simply won’t work.

You Can’t Find A Bank That Would Let You Cash Out

In our previous queries to multiple banks, simply no banks would deal with you for the fear of money laundering fines. If you cash out in the United States, then you would have serious difficulty in explaining why you didn’t register your ICO as securities or other regulated financial products beforehand.

The Only Jurisdiction That Gives No Legal Hurdles to ICOs – Belarus

Currently, there’s only one place that legally allows for ICOs. That place is Belarus. But even so, as of today, their banks refused to deal with cryptocurrency clients.

That’s why their only local exchange called Exrate.by couldn’t launch as planned.

–

Even if you found some ways to cash out for the Belarusian Rubles with the locals through LocalBitcoins, and then deposit those Belarusian Rubles in an established bank shown below, you would still have problems.

–

All the banks in developed parts of the world have signed anti-money laundering treaties, and when they onboard you as a client, they have boxes to tick. One of them, they ask if you have a previous course of dealings with any Belarusian institutes. And if you do, your application will get rejected.

–

So even if you were able to cash out for Belarusian Rubles in Belarus, you can’t send that money anywhere abroad.

The Take-Away: I Think All The Money Are Really Still Inside The Ecosystem

If this understanding is accurate, then the price up or down of the ETH is really only a false alarm. Because the ICO money hasn’t actually left. They are somehow still trapped in the ecosystem. And when the time is ripe, I suspect that this sum of money will buy in again.

I could be wrong. But this is the only sensible interpretation I can come up with, from my years of experience working in the financial industry.

(These are just my views. This article doesn’t represent the views of the website hosts.)

by Yanna L, Hong Kong

11 September 2018